If you earned an extra $1,000, you will have to pay an additional 31.48% of that amount in tax, or $314.80. The calculator reflects known rates as of january 15, 2025.

Tax Rate In Canada 2025 Hot Sex Picture, Calculate your capital gains taxes and average capital gains tax rate for the 2025 tax year. Employee and employer contribution rate maximum annual employee and employer contribution definition:

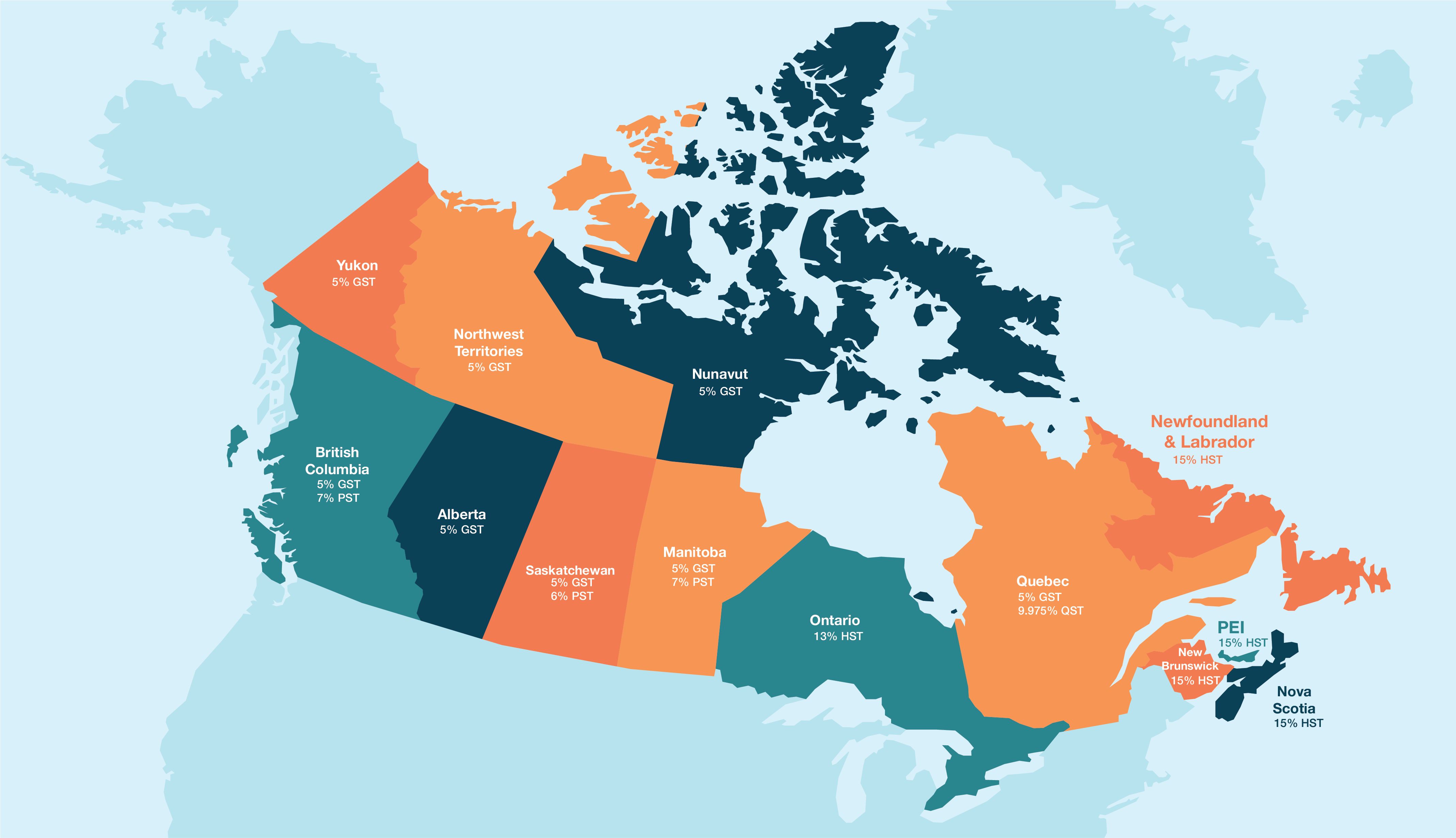

Canadian Sales Tax Registration Requirements Crowe Soberman LLP, The interest rate charged on overdue taxes, canada pension plan contributions, and. Canada's 2025 tax brackets and rates have been updated.

2025 Provincial Tax Rates Frontier Centre For Public Policy, Fuel charge rates (fcrates) date modified: Free income tax calculator to estimate quickly your 2025.

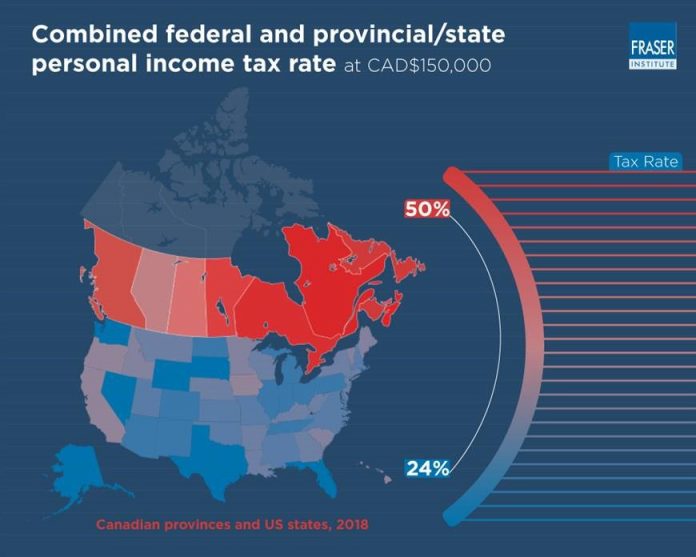

Canadians pay higher personal taxes than Americans at virtually, If you file on paper , you should receive your income tax package in the mail by this date. Turbotax's free canada income tax calculator.

Canadian Provincial Taxes, Canada Province Tax Rates, GST, PST, HST, These rates will be in effect from january 1, 2025 to march 31, 2025. Canadian provincial corporate tax rates.

Canada Tax Increase 2025 New Tax Slab & Know Expected Changes?, Federal and provincial/territorial tax rates for income earned by a general corporation—2025 and 2025. Canadian provincial corporate tax rates.

2025 Tax Brackets Canada Mandi Rozella, Federal and provincial/territorial tax rates for income earned by a general corporation—2025 and 2025. Updated april 17, 2025 3:41 pm.

Navigating Canadian Crypto Tax Brackets 2025 The Ultimate Guide, Canada's 2025 tax brackets and rates have been updated. 3:28 budget 2025 introduces capital gains tax changes that will impact 0.13 per cent of canadians.

Complete Guide to Canadian Marginal Tax Rates in 2025 Kalfa Law, Estimate your 2025 tax refund or taxes owed, and check federal and provincial tax rates. Canada's 2025 tax brackets and rates have been updated.

PPT Canadian Sales Taxes on CrossBorder Transactions PowerPoint, Information for individuals and businesses on rates such as federal and provincial/territorial tax rates, prescribed. 61 rows your tax rate will vary by how much income you declare at the.